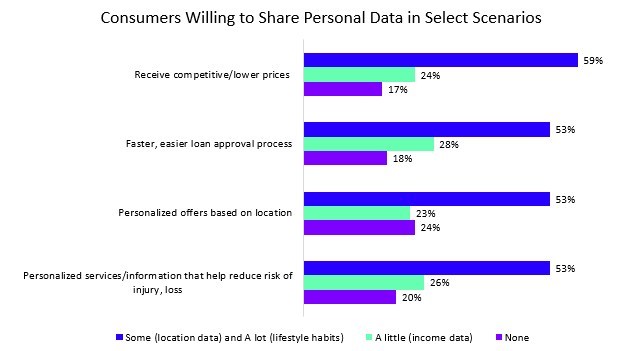

Press Release: “Nearly half of Canadian consumers would be willing to share significant personal information, such as location data and lifestyle information, with their bank and insurer in exchange for lower pricing on products and services, according to a new report from Accenture (NYSE: ACN).

Accenture’s global Financial Services Consumer Study, based on a survey of 47,000 consumers in 28 countries which included 2,000 Canadians, found that more than half of consumers would share that data for benefits including more-rapid loan approvals, discounts on gym memberships and personalized offers based on current location.

At the same time, however, Canadian consumers believe that privacy is paramount, with nearly three quarters (72 per cent) saying they are very cautious about the privacy of their personal data. In fact, data security breaches were the second-biggest concern for consumers, behind only increasing costs, when asked what would make them leave their bank or insurer.

“Canadian consumers are willing to sharing their personal data in instances where it makes their lives easier but remain cautious of exactly how their information is being used,” said Robert Vokes, managing director of financial services at Accenture in Canada. “With this in mind, banks and insurers need to deliver hyper-relevant and highly convenient experience in order to remain relevant, retain trust and win customer loyalty in a digital economy.”

Consumers globally showed strong support for personalized insurance premiums, with 64 per cent interested in receiving adjusted car insurance premiums based on safe driving and 52 per cent in exchange for life insurance premiums tied to a healthy lifestyle. Four in five consumers (79 per cent) would provide personal data, including income, location and lifestyle habits, to their insurer if they believe it would help reduce the possibility of injury or loss.

In banking, 81 per cent of consumers would be willing to share income, location and lifestyle habit data for rapid loan approval, and 76 per cent would do so to receive personalized offers based on their location, such as discounts from a retailer. Approximately two-fifths (42 per cent) of Canadian consumers specifically, want their bank to provide updates on how much money they have based on spending that month and 46 per cent want savings tips based on their spending habits.

Appetite for data sharing differs around the world

Appetite for sharing significant personal data with financial firms was highest in China, with 67 per cent of consumers there willing to share more data for personalized services. Half (50 per cent) of consumers in the U.S. said they were willing to share more data for personalized services, and in Europe — where the General Data Protection Regulation took effect in May — consumers were more skeptical. For instance, only 40 per cent of consumers in both the U.K. and Germany said they would be willing to share more data with banks and insurers in return for personalized services…(More)”,